AI Tools for Accounting: Revolutionizing the Financial Sector

Artificial Intelligence (AI) is swiftly transforming the landscape of the accounting sector, making waves with its capability to process and analyze financial data with remarkable efficiency. By empowering financial professionals to operate faster, smarter, and with unprecedented accuracy, AI is not replacing accountants but rather, elevating their capabilities. This shift towards AI-driven processes signifies more than just automation of tedious tasks like data entry, invoice processing, and reconciliations; it heralds a new era where technology and human expertise converge to optimize financial operations.

The introduction of AI tools for accounting, including some of the best AI accounting software, is revolutionizing how accounts payable and accounts receivable are managed. This article explores the forefront of this transformation, highlighting the best AI tools for accounting that are reshaping financial workflows. From automating repetitive tasks to enhancing analytical capabilities and ensuring compliance with regulatory standards, these tools offer a comprehensive look into the future of accounting. Through a closer examination of their advantages and challenges, we will discover how AI is poised to transform the financial sector, making the profession more attractive and efficient.

AI In Accounting and Finance

The adoption of AI in the accounting and finance industry is rapidly transforming how professionals approach their work, offering unprecedented efficiency and accuracy. Here's a closer look at the current landscape:

Adoption Rates and Professional Insights:

- Currently, about 15% of accounting firms either use AI tools or are planning to adopt them soon, showcasing a growing acceptance within the industry.

- A significant 73% of 771 tax professionals have recognized AI's potential in tax, accounting, and audit work, indicating a positive outlook towards AI integration in financial tasks.

AI Applications and Benefits:

- Automated Accounting Tasks: AI excels in automating various accounting functions such as payroll, tax management, banking, and audits, significantly reducing manual effort and the chance of human error.

- Robotic Process Automation (RPA): This technology is adept at completing repetitive tasks efficiently, enhancing productivity within business processes.

- Advanced Data Analysis: AI's capability to analyze large volumes of financial data helps in identifying irregular patterns and anomalies, which could indicate fraudulent activities or financial inconsistencies.

- Real-Time Processing and Predictive Insights: Utilizing natural language processing and computer vision, AI tools can process documents in real-time. Moreover, they offer insights into historical cash flows and predict future cash requirements, aiding in more informed decision-making.

Challenges and Considerations:

- Despite the promising benefits, integrating AI into accounting practices comes with its set of challenges. These include unforeseen developments, security concerns, and the need for professionals to adapt to new technologies.

- The AI in the accounting market, currently valued at $1.56 billion, is expected to grow to $6.62 billion by 2029. This rapid growth underscores the importance of addressing implementation challenges, such as staff resistance and data security concerns, to fully harness AI's potential in revolutionizing the financial sector.

AI tools for accounting, such as Docyt AI, QuickBooks with Intuit Assist, and Xero's AI features, are leading examples of how AI and machine learning technologies are being leveraged to enhance efficiency, accuracy, and scalability in financial operations. These tools not only automate almost all accounting tasks but also provide deep insights, improve output quality, and ensure compliance, making them invaluable assets for businesses aiming to stay competitive in the ever-evolving financial landscape.

Table Of Content

Exploring the transformative power of AI in accounting, our journey through this article will uncover the capabilities and impact of various AI tools designed to streamline and enhance financial operations. Here's what to expect:

Vic.ai: Revolutionizing Accounts Payable

- Overview: Discover how Vic.ai leverages artificial intelligence to automate and optimize accounts payable processes.

- Pros and Cons: Weighing the benefits against the potential limitations of implementing Vic.ai in your financial workflow.

Docyt: Simplifying Financial Data Management

- Overview: An in-depth look at Docyt's AI-driven approach to managing financial data, from receipts to comprehensive financial reports.

- Pros and Cons: Evaluating Docyt's effectiveness in simplifying data management against any challenges users might face.

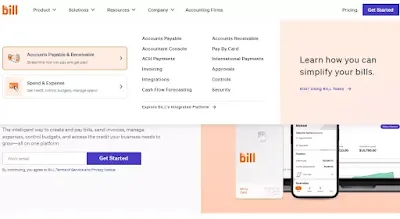

Bill.com: Streamlining Invoice Management and Payments

- Overview: Understanding how Bill.com uses AI to transform invoice management and payment processes for businesses of all sizes.

- Pros and Cons: Assessing the advantages of Bill.com's platform alongside considerations for businesses contemplating its adoption.

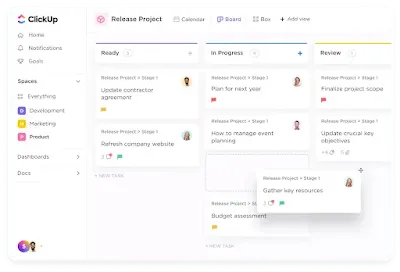

ClickUp: Enhancing Productivity with AI Tools

- Overview: A glimpse into how ClickUp integrates AI to boost productivity in managing accounting tasks and projects.

- Pros and Cons: Analyzing the impact of ClickUp's AI features on productivity, with a balanced view of its limitations.

Indy: Tailored AI Solutions for Freelancers and Small Businesses

- Overview: Exploring Indy's customized AI tools designed to meet the unique accounting needs of freelancers and small businesses.

- Pros and Cons: Deliberating the specialized benefits Indy offers to its niche audience against any potential drawbacks.

Zeni: AI-Powered Financial Concierge for Startups

- Overview: Delve into how Zeni provides AI-driven financial insights and services tailored specifically for startups.

- Pros and Cons: Considering the innovative solutions Zeni brings to startup financial management versus the challenges it may present.

Each section will provide insights into how these AI tools for accounting are shaping the future of financial management, highlighting their unique selling propositions and real-life applications. By comparing their features, benefits, and limitations, we aim to offer a comprehensive understanding of the best AI accounting software and tools available, enabling businesses and professionals to make informed decisions in adopting AI technologies for their accounting needs.

Vic.ai

Vic.ai stands out as a revolutionary AI-based accounting software, meticulously designed to enhance productivity, decision-making, and return on investment (ROI) in accounting and finance operations. Developed by leading AI engineers, Vic.ai aims to empower finance teams and guide businesses through their AI journey, offering a suite of features tailored to meet the dynamic needs of modern accounting practices.

Key Features and Benefits:

- Automation Excellence: Vic.ai has achieved human-level accuracy in automating critical tasks such as bill processing, approval workflows, and digital payment processing. This significantly reduces manual labor and the potential for errors.

- Insightful Analytics: The software provides real-time insights, benchmark data, and cost optimization strategies, utilizing AI and statistical analysis to inform better financial decisions.

- Seamless Integration: With support for an open API and a common data model, Vic.ai easily integrates with existing ERP systems, facilitating custom workflows and enhancing operational efficiency.

- Comprehensive Accounting Solutions: Features include General Ledger, CPA Firms collaboration, Billing and Invoicing, Accounts Payable, and Tax Management, making it a one-stop solution for diverse accounting needs.

- User Experience: Positive user feedback highlights the software's automation capabilities, time-saving features, and the AI's proficiency in predicting accounting decisions. The ease of data entry, facilitated by AI's ability to read and extract data from invoices, is particularly appreciated.

Challenges and Considerations:

- Some users have reported issues with duplicate invoices and emails being marked as spam, indicating areas for improvement in the software's filtering algorithms.

- The complexity of pulling specific reports related to employee uploads has been noted as a challenge, suggesting a need for enhanced reporting features.

- While users commend the customer service for its patience and understanding, there is a desire for more intuitive navigation and automatic reminder notifications for approvals, pointing towards potential enhancements in user interface design and functionality.

Pricing for Vic.ai starts at $1,490.00 per month, with custom plans available to cater to the specific needs of businesses. This investment in cutting-edge AI technology for accounting operations promises to streamline payment processes, minimize manual errors, and offer strategic insights, positioning Vic.ai as a valuable asset for accounting teams looking to leverage the power of AI in their financial workflows.

Docyt

Docyt emerges as a comprehensive AI-based accounting solution, meticulously engineered to revolutionize the way businesses manage their financial processes. With its innovative Docyt360 platform, it offers a suite of automation tools including ExpenseFlow, RevFlow, ClosingFlow, and InsightFlow, designed to streamline every aspect of bookkeeping from expense management to financial reporting. Catering to a wide array of industries such as Accounting Firms & CPAs, Hospitality, and High Growth Startups, Docyt demonstrates versatility and adaptability to various financial management needs.

Key Features and Benefits:

- End-to-End Bookkeeping Automation: Docyt360 simplifies financial management with tools for expense management, revenue reconciliation & accounting, month-end closing, and real-time financial reporting.

- Industry-Specific Solutions: Tailored use cases for multi-location accounting, catch-up bookkeeping, and industry-specific reporting, making it ideal for businesses across sectors including Retail & E-commerce, Franchise Management, and Dental Offices.

- Advanced AI Capabilities: Powered by an AI Research Lab focused on Model Development and Responsible AI, Docyt offers generative AI products to automate mundane tasks, significantly reducing time and minimizing errors.

Challenges and Considerations:

- While Docyt offers extensive features, businesses may face challenges in ERP data migration and adapting to the comprehensive suite of tools available.

- The platform's advanced AI capabilities, including Generative AI, require users to have a certain level of tech-savviness to fully leverage the software's potential.

Docyt not only automates repetitive bookkeeping tasks but also provides a secure place for all critical financial information, ensuring data security and management with robust integrations. Its AI-powered platform allows for real-time insights into expenses, revenue, and profitability, offering multi-entity accounting and the provision of both roll-up and individual financial statements. Additionally, Docyt's commitment to professional development and learning about AI in accounting is evident through its university section and a wealth of resources including a blog and events. With pricing options available for both businesses and accounting firms/CFO services, Docyt positions itself as a leading AI tool for accounting, revolutionizing back-office tasks and paving the way for more efficient, error-free financial management.

Bill

Bill.com stands as a pivotal tool in the financial sector, particularly for businesses aiming to streamline their accounts payable and receivable processes. This cloud-based platform offers a comprehensive suite of features designed to enhance the efficiency and security of financial transactions, making it an indispensable tool for accounting firms and businesses alike.

Key Features of Bill.com:

- Accounts Payable & Receivable: Automates and simplifies the entire process, from invoice creation to payment receipt, ensuring timely transactions.

- Accounts Payable includes options for domestic ACH, virtual card, or check payments, providing flexibility and ease.

- Accounts Receivable digitizes payment receiving processes and seamlessly syncs with major accounting software, ensuring accurate bookkeeping.

- Spend & Expense Management:

- The Spend & Expense feature allows for comprehensive management and control over business expenditure.

- Expense Management simplifies the tracking and reporting of expenses, enhancing financial oversight.

- Budget Management aids in setting and tracking budgets, ensuring financial goals are met.

- Integration and Security:

- Integrates with leading accounting software like QuickBooks, Sage Intacct, Oracle Netsuite, Microsoft Dynamics, and Xero, facilitating streamlined financial operations.

- Offers robust security measures, including data encryption and secure payment methods, to protect sensitive financial information.

Pros:

- Customized Branded Portal Capabilities that enhance the professionalism of transactions with automatic reminders and notifications.

- Mobile App functionality enables financial management on the go, increasing operational flexibility.

- Virtual Card and Cash Flow Forecasting features provide secure payment options and future financial planning capabilities.

Cons:

- The extensive features and integrations may require a learning curve for new users to fully leverage the platform’s capabilities.

- For smaller businesses, the cost of Bill.com, when considering all its functionalities, might be a significant factor to consider.

Bill.com's automation solutions cater to both small businesses and midsize companies across various industries, including construction, education, healthcare, and more. This adaptability, coupled with a rich resource center offering customer stories, learning materials, and professional insights, solidifies Bill.com's position as a leading ai tool for accounting. Its ability to support multiple types of payments, including ACH, credit card, and PayPal, further demonstrates its versatility and commitment to accommodating the diverse needs of its users.

ClickUp

ClickUp is not just a project management tool; it's a versatile platform that caters to a wide range of organizational needs, including financial management. With features designed to streamline project accounting and auditing tasks, ClickUp offers a comprehensive solution for businesses looking to optimize their financial workflows.

Key Features and Benefits:

- Comprehensive Project Management: ClickUp's suite includes tasks, docs, goals, whiteboards, dashboards, and chat, making it a one-stop shop for managing projects of any scale.

- Financial Management Tools:

- Custom dashboards and powerful automatic calculations enable precise financial oversight.

- Recurring tasks and custom fields facilitate streamlined expense tracking and budget management.

- Templates and Integrations:

- The Finance Management Template and ClickUp Accounting Template are fully customizable, ready-to-use workspaces for financial management, including features for managing invoices, sales records, income, and predicted revenue.

- With over 1,000 ready-made integrations, ClickUp enhances its functionality, allowing for seamless synchronization with other tools, keeping everything accessible from a single, customizable dashboard.

Pros:

- Versatile use cases including project management, remote work, CRM, and specifically tailored solutions for enterprise, startup, and non-profit organizations.

- Extensive project budgeting, reporting, and tracking features, alongside integration with other business systems and apps.

- AI work assistant and document management platform streamline operations, while a user-friendly interface ensures ease of use.

Cons:

- Despite its extensive features, ClickUp is not a replacement for dedicated bookkeeping software like QuickBooks or Xero, and may require additional tools for comprehensive financial management.

- The platform's wide array of functionalities might present a learning curve for new users to fully utilize its potential.

In essence, ClickUp stands as a powerful ally for businesses aiming to integrate project management with financial tracking and analysis. Its adaptability across various organizational types and the inclusion of specialized financial management templates make it a valuable asset for enterprises seeking to enhance efficiency and accuracy in their financial operations.

Indy

Indy represents a versatile and comprehensive AI accounting tool designed specifically for the needs of independent professionals, freelancers, and small business owners. With its rich array of features, Indy simplifies the management of financial and administrative tasks, allowing users to focus more on their core business activities.

Key Features and Benefits:

- Unified Workspace: Indy offers a dedicated space integrating various functionalities like project management, calendar scheduling, contract creation and management, file storage with revision tracking, forms for various purposes (lead generation, project information, etc.), invoice generation, proposal creation, task management, and a time tracker. This consolidation of tools enhances efficiency by keeping all necessary operations under one roof.

- Client and Team Collaboration: Through project portals, Indy facilitates seamless collaboration between clients and teams, ensuring everyone is aligned and informed. This shared space enhances transparency and streamlines communication.

- Comprehensive Financial Management: The platform excels in providing a full suite of accounting features including but not limited to automatic bank synchronization, transaction categorization, VAT detection, and unique elements like tax calculation, task editing/updating, and invoice processing prioritization. Additionally, Indy supports integrations with popular services such as Zapier, Google Calendar, PayPal, and Stripe, further broadening its utility.

Pros:

- Offers a free plan that includes unlimited access to a variety of features, making it accessible for freelancers and small businesses with tight budgets.

- The platform's design and functionalities cater specifically to the unique needs of various professionals, including doctors, architects, lawyers, and part-time freelancers, providing a tailored user experience.

- Indy's recent funding success and expansion plans, including the introduction of a free business bank account, indicate a strong growth trajectory and commitment to providing comprehensive services.

Cons:

- While Indy offers a wide range of functionalities, it may present a learning curve for users unfamiliar with such comprehensive platforms.

- The platform's focus on French-speaking markets and professionals might limit its accessibility and utility for non-French speaking users, despite its support for English.

Indy's approach to integrating essential business and financial management tools into a single platform positions it as a valuable asset for freelancers and small businesses. Its commitment to easing the administrative burden through AI and automation, coupled with its affordable pricing structure and supportive community resources, makes Indy a compelling choice for those looking to streamline their operations.

Zeni

Zeni Accounts emerges as a beacon of innovation in the AI tools for the accounting landscape, offering a holistic solution to the financial management needs of startups and growing businesses. At the heart of Zeni's offering is its Dashboard, providing a unified view of all finance operations, including accounts payable, accounts receivable, cash management, and more. This real-time visibility into financial operations is complemented by Zeni's comprehensive suite of services, which includes:

- Automated Bookkeeping and CPA Oversight: Ensuring accuracy and compliance with regulatory standards.

- Tax Filing Services: Simplifying the annual startup tax filing process, including R&D tax credit calculation.

- Fractional CFO Services: Offering strategic financial advice and analysis for businesses not ready to hire a full-time CFO.

- Bill Pay and Employee Reimbursements: Streamlining payment processes to ensure timely transactions.

Pros:

- Stress-Free Accounting: Zeni's AI-driven platform automates accounting, spending, and budgeting processes, significantly reducing manual effort and minimizing the risk of errors.

- Clarity on Business Finances: Provides clear, actionable insights into financial health, enabling better business decisions.

- Seamless Finance Management: Integrates with existing financial systems for a cohesive management experience.

- Security and Compliance: Offers electronic tax filing and regulatory compliance, ensuring businesses meet all legal financial obligations.

Cons:

- Learning Curve: The comprehensive nature of Zeni's services may require an initial adjustment period for businesses to fully leverage its capabilities.

- Pricing: With plans starting at $299 per month, smaller businesses or startups on a tight budget might find it challenging to justify the cost.

Zeni's unique approach to financial management is further enhanced by its commitment to providing real-time, data-driven insights through its templated dashboards that update daily. This focus on delivering timely and accurate reports, coupled with a wide range of accounting features, positions Zeni as a valuable partner for businesses seeking to navigate the complexities of financial management with ease and confidence. Whether it's managing the general ledger, reconciling bank statements, or preparing for board meetings, Zeni offers a comprehensive, AI-powered solution designed to meet the dynamic needs of today's businesses.

Conclusion

As we've journeyed through the revolutionary landscape of AI tools for accounting, it's evident that technology's role in financial management is not just transformative but also empowering. The detailed exploration of leading software, including Vic.ai, Docyt, Bill.com, ClickUp, Indy, and Zeni, has underscored their substantial benefits in enhancing efficiency, accuracy, and strategic financial decision-making. Each tool, with its unique capabilities, from automating mundane tasks to providing in-depth financial analyses and fostering collaboration, showcases the dynamic potential AI holds to revolutionize accounting practices. Their advantages, coupled with the challenges and considerations, offer a comprehensive lens through which the future of accounting can be viewed—a future where AI and human expertise coalesce to elevate the financial sector to new heights.

In reflecting upon this evolution, it's clear that the integration of AI into accounting practices is not just a trend but a necessary pivot to remain competitive and responsive to the ever-changing financial landscape. The implications of these technological advancements extend beyond mere operational efficiency; they represent a paradigm shift towards more informed, data-driven decision-making processes. As businesses and professionals navigate the complexities of financial management, embracing these AI tools can lead to unparalleled opportunities for growth, innovation, and sustainability. In conclusion, the journey into AI-enhanced accounting is not without its challenges, but the potential rewards for those who adapt are both significant and far-reaching, promising a future where the bounds of financial possibility are continually expanded.

FAQs

How is AI transforming the finance industry? AI is revolutionizing the finance industry by enhancing data analysis capabilities. It surpasses traditional data processing by offering rapid and precise analysis of extensive data sets, leading to insights that were once difficult or impossible to obtain.

What role does AI play in financial accounting? In financial accounting, AI is instrumental in automating the preparation of audit schedules from financial data, scrutinizing financial information, and identifying irregularities that require further examination by auditors from CPA firms.

Which AI tool is designed to resolve accounting challenges? Dext Precision is an AI tool designed to streamline accounting tasks. It simplifies the management of financial records, such as receipts and invoices, by facilitating data entry, minimizing manual efforts, and enhancing the accuracy of financial documentation.

In what ways is artificial intelligence employed in the financial sector? AI is utilized in the financial sector for a variety of purposes, including personalizing services and products, generating new opportunities, managing risks and detecting fraud, ensuring transparency and compliance, and automating operations to lower costs.

.png)